Mar 1, 2024You can form your California S corp by completing and filing Form 2553 with the IRS. In California, an S corp has a franchise tax of 1.5%.

Create the career you love | Pinterest Careers

Mar 4, 2024In order to start an S corp in California, a business must first have a formal business structure (i.e., an LLC or corporation) and then elect to be taxed as a California S corp. This guide will show you how to start an S corp in California and provide you with insights on keeping your California S corp compliant.

Source Image: linkedin.com

Download Image

Filing requirements You must file California S Corporation Franchise or Income Tax Return (Form 100S) if the corporation is: Incorporated in California Doing business in California Registered to do business in California with the Secretary of State (SOS) Receiving California source income

Source Image: policy.pinterest.com

Download Image

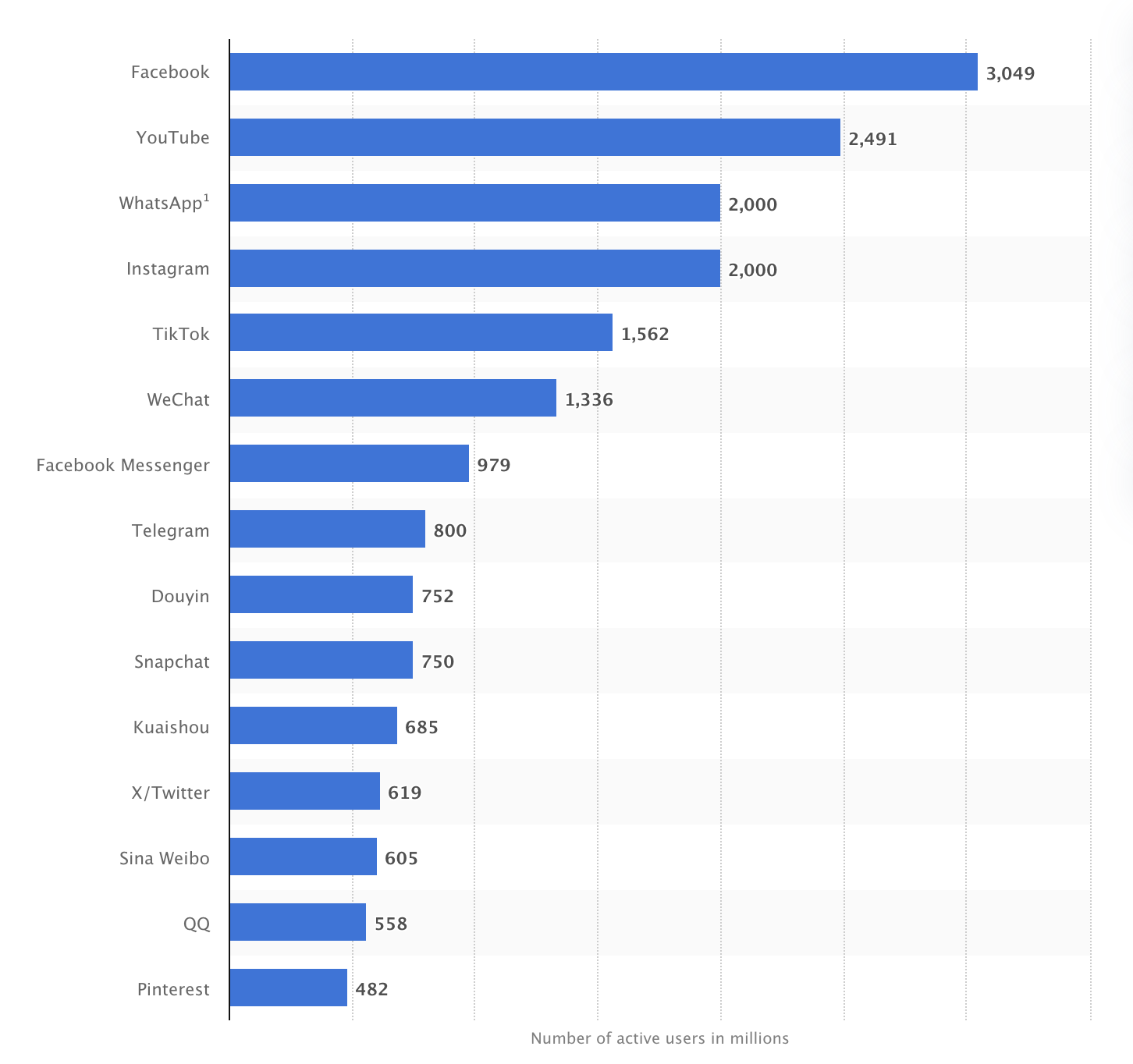

51 Pinterest Statistics You Need to Know in 2024 – Omnicore Agency After the formation of the corporation, the election to be treated as an S corporation is filed with the IRS . A California S-Corp is also known as a CA S-Corp. When choosing the name for your California S-Corp, be sure the name is available. The name itself must indicate the status of corporation by including “Inc.” or “Incorporated

Source Image: nbcnews.com

Download Image

How To Create An S Corp In California

After the formation of the corporation, the election to be treated as an S corporation is filed with the IRS . A California S-Corp is also known as a CA S-Corp. When choosing the name for your California S-Corp, be sure the name is available. The name itself must indicate the status of corporation by including “Inc.” or “Incorporated Although California’s tax rules generally follow the federal rules for computing the S corporation’s income, California taxes this income at the corporate level. As of January 1, 2016, an S corporation’s net income is taxed at 1.5 percent. That’s not all. In California, an S corporation’s income is taxed a second time when it is passed

3 dead as storm pummels California, causing flooding and dozens of mudslides in L.A. area

6 days agoTo have a California S corporation, you’ll need to create either a limited liability company (LLC) or a C corporation (the default form of corporation) if you haven’t already done so. Then, you’ll file an election form with the Internal Revenue Service (IRS). Investigation: How Pinterest drives men to little girls’ images

Source Image: nbcnews.com

Download Image

Pinterest – India 6 days agoTo have a California S corporation, you’ll need to create either a limited liability company (LLC) or a C corporation (the default form of corporation) if you haven’t already done so. Then, you’ll file an election form with the Internal Revenue Service (IRS).

Source Image: in.pinterest.com

Download Image

Create the career you love | Pinterest Careers Mar 1, 2024You can form your California S corp by completing and filing Form 2553 with the IRS. In California, an S corp has a franchise tax of 1.5%.

Source Image: pinterestcareers.com

Download Image

51 Pinterest Statistics You Need to Know in 2024 – Omnicore Agency Filing requirements You must file California S Corporation Franchise or Income Tax Return (Form 100S) if the corporation is: Incorporated in California Doing business in California Registered to do business in California with the Secretary of State (SOS) Receiving California source income

Source Image: omnicoreagency.com

Download Image

How To Start an S Corporation In California – Step By Step Guide (2022) – YouTube Mar 2, 2023To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors. What Are the Benefits of Establishing an S Corps in California?

Source Image: m.youtube.com

Download Image

Pinterest Developers After the formation of the corporation, the election to be treated as an S corporation is filed with the IRS . A California S-Corp is also known as a CA S-Corp. When choosing the name for your California S-Corp, be sure the name is available. The name itself must indicate the status of corporation by including “Inc.” or “Incorporated

Source Image: developers.pinterest.com

Download Image

42 Pinterest Stats That Matter to Marketers in 2024 Although California’s tax rules generally follow the federal rules for computing the S corporation’s income, California taxes this income at the corporate level. As of January 1, 2016, an S corporation’s net income is taxed at 1.5 percent. That’s not all. In California, an S corporation’s income is taxed a second time when it is passed

Source Image: blog.hootsuite.com

Download Image

Pinterest – India

42 Pinterest Stats That Matter to Marketers in 2024 Mar 4, 2024In order to start an S corp in California, a business must first have a formal business structure (i.e., an LLC or corporation) and then elect to be taxed as a California S corp. This guide will show you how to start an S corp in California and provide you with insights on keeping your California S corp compliant.

51 Pinterest Statistics You Need to Know in 2024 – Omnicore Agency Pinterest Developers Mar 2, 2023To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors. What Are the Benefits of Establishing an S Corps in California?